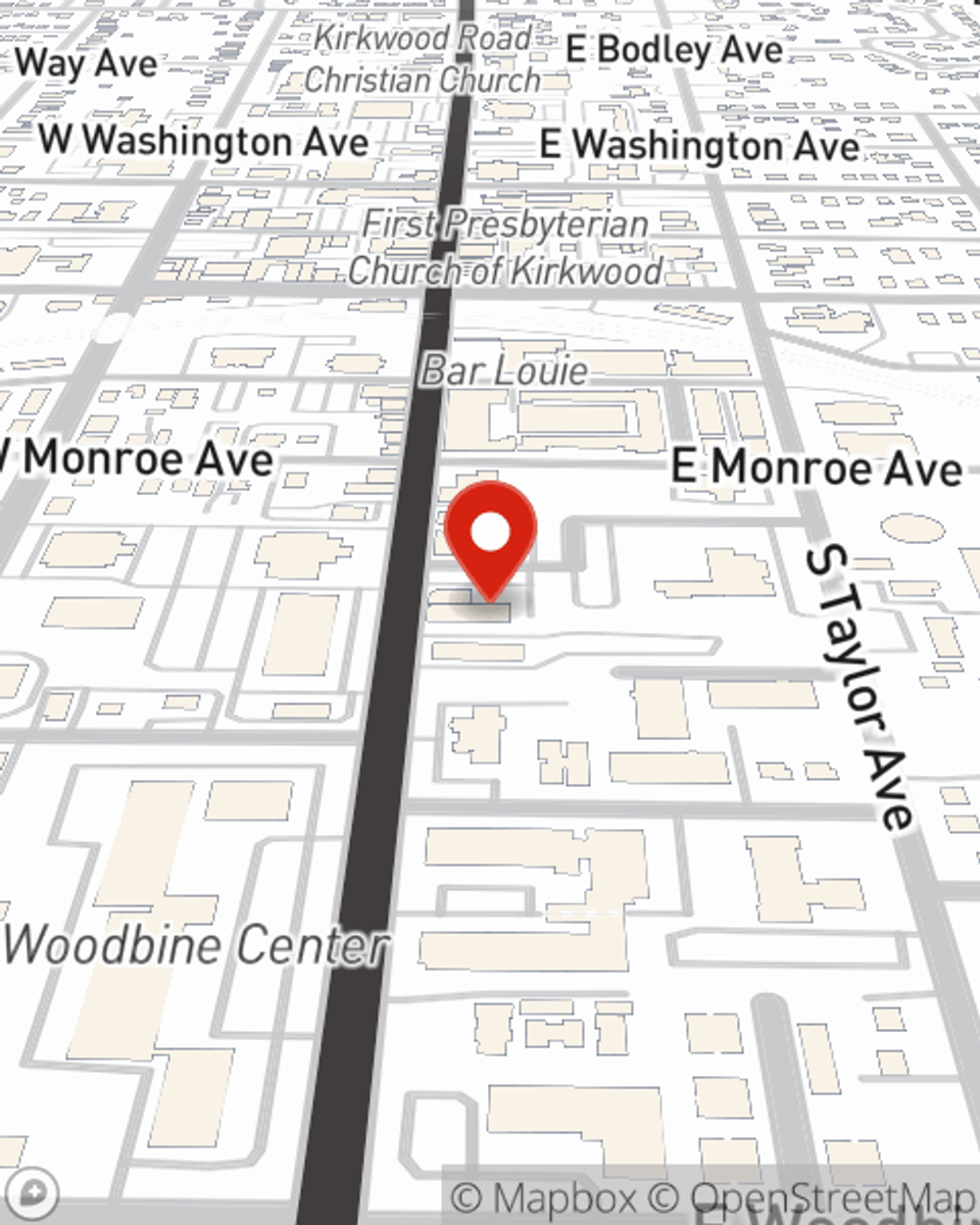

Business Insurance in and around Kirkwood

Calling all small business owners of Kirkwood!

Helping insure small businesses since 1935

- Kirkwood

- Webster Groves

- Creve Coeur

- Frontenac

- Ladue

- Sunset Hills

- Crestwood

- Rock Hill

- Glendale

- Brentwood

- Chesterfield

- St. Charles

- Ballwin

- Manchester

- St. Charles County

- St. Louis County

- Jefferson County

- Des Peres

- St. Louis

- Wildwood

- Fenton

- Clayton

- Ellisville

- Valley Park

Help Prepare Your Business For The Unexpected.

When experiencing the highs and lows of small business ownership, let State Farm take one thing off your plate and help provide excellent insurance for your business. Your policy can include options such as worker's compensation for your employees, business continuity plans, and a surety or fidelity bond.

Calling all small business owners of Kirkwood!

Helping insure small businesses since 1935

Customizable Coverage For Your Business

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Jake Molitor for a policy that covers your business. Your coverage can include everything from business continuity plans or errors and omissions liability to mobile property insurance or commercial auto insurance.

Ready to review the business insurance options that may be right for you? Stop by agent Jake Molitor's office to get started!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Jake Molitor

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.